002. The "Six-Figure Business" Deception

===

INTRO

---

Lisa: [00:00:00] Simplicity, balance, and efficiency shouldn't just be items on your eternal wishlist. If you're a side hustler or mompreneur who wants to level up and be a true CEO, create a business that supports your family while still maintaining a life you love, you're in the right place. I'm your host, Lisa Kinser, and you're listening to The Simply Booked Podcast. I'm a wife, #girlmom of two, bookkeeper, and owner of Simply Booked, LLC. Where I help small business owners like you know and grow their profits. So heat that cup of coffee for the third time this morning, and let's get started.

CONTENT

---

Lisa: Hello, hello! Thank you for joining me again on The Simply Booked Podcast. Welcome to episode two, where I might be dropping a bit of a hot take. If you're new to the online business arena, this might come as a surprise, but it's very common for business owners to claim that they have a six-figure business or a multiple six-figure business, or even a [00:01:00] seven-figure business. So what does that mean? $100,000 is the lowest amount you could make and claim to be a six-figure business.

$100,000 is a lot of money, but what they're not telling you, is there a profit margin! What is a profit margin? It's hard to know your elusive profit margin. If you don't track your business finances regularly. So let's break this down. I'm going to use an example of a product based business. Let's say you sell t-shirts.

So you buy a t-shirt for $10. Maybe you mark it up. You want to sell it for 20. You might think Lisa that's a 50% profit margin. And I would tell you. No, that's not true. It's not that simple. Because you also have other expenses, right? You're not really selling that shirt for $20. I mean you are, but it costs you money to ship that t-shirt it costs you money to host the website.

It costs you money [00:02:00] to insure your business. You probably also have credit card fees. Do you see where I'm going with this? Have you ever wondered what it really means when someone claims to have a six-figure business? Simply put, it means that they have earned six figures of revenue. Revenue.

And it usually means that revenue was earned during the same fiscal year, which for most small businesses, the fiscal year and the calendar year are the same thing. I'm not trying to confuse you here, but that typically runs January through December. So you make six-figures of revenue from January through December.

Revenue is a term that's interchangeable with income and sales. So you'll hear me use revenue, income and sales interchangeably. Do you want to know a secret? That doesn't give any indication of their profit, or how much they pay themselves for running that business. This all boils down to a simple equation; one that I am extremely familiar with. [00:03:00]

It's: REVENUE - EXPENSES = PROFIT.

I'm going to say that again, REVENUE - EXPENSES = PROFIT. And depending on the business model and the owner's standards, they may or may not pay themselves the full amount that their business profits anyway. If you're familiar with the Profit First methodology, you might know what I'm talking about there, but that's a topic for another episode. I do plan on talking about Profit First at some point.

But what do you think the difference is between a six figure business claim in air quotes? You can't see me doing air quotes, but I did them anyway.

What's the difference between a six figure claim? And what an owner actually pays themselves. You guessed it, the answer is in that equation I just gave you. Do you remember what it was? That's right. It was expenses. That's the difference? I'm not saying that six figures of sales is not an outstanding milestone and certainly one to be celebrated and shouted [00:04:00] from the rooftops. If you've hit that milestone, it's a big deal.

But it doesn't give a good picture of the business's health or profitability. So keep that in mind when you hear people bragging that they have a six-figure business, okay? And hopefully I will grow awareness to this and maybe listeners of my podcast won't also do this because it's misleading, y'all!

So many other factors are at play when determining a business's health. Since I brought it up. Profit is arguably one of the most important factors though. And one that unfortunately, a lot of business owners don't know their own profitability. They don't know their profit percentage. In fact, that is primarily what the IRS cares the most about when tax time rolls around every year.

And what CPAs lose their sleep over for months leading up to tax deadlines in order to send accurate numbers to the IRS, which ultimately helps determine your tax liability as a business [00:05:00] owner. Does the IRS want to know your six-figure sales number? You bet they do. And unless you track and document your deductible expenses. Keep in mind, I said deductible expenses... "deductible" being the keyword. You have to submit those along with that six figure sales number, your tax liability could end up being much larger than it should be if you don't track those deductible expenses, which are very important.

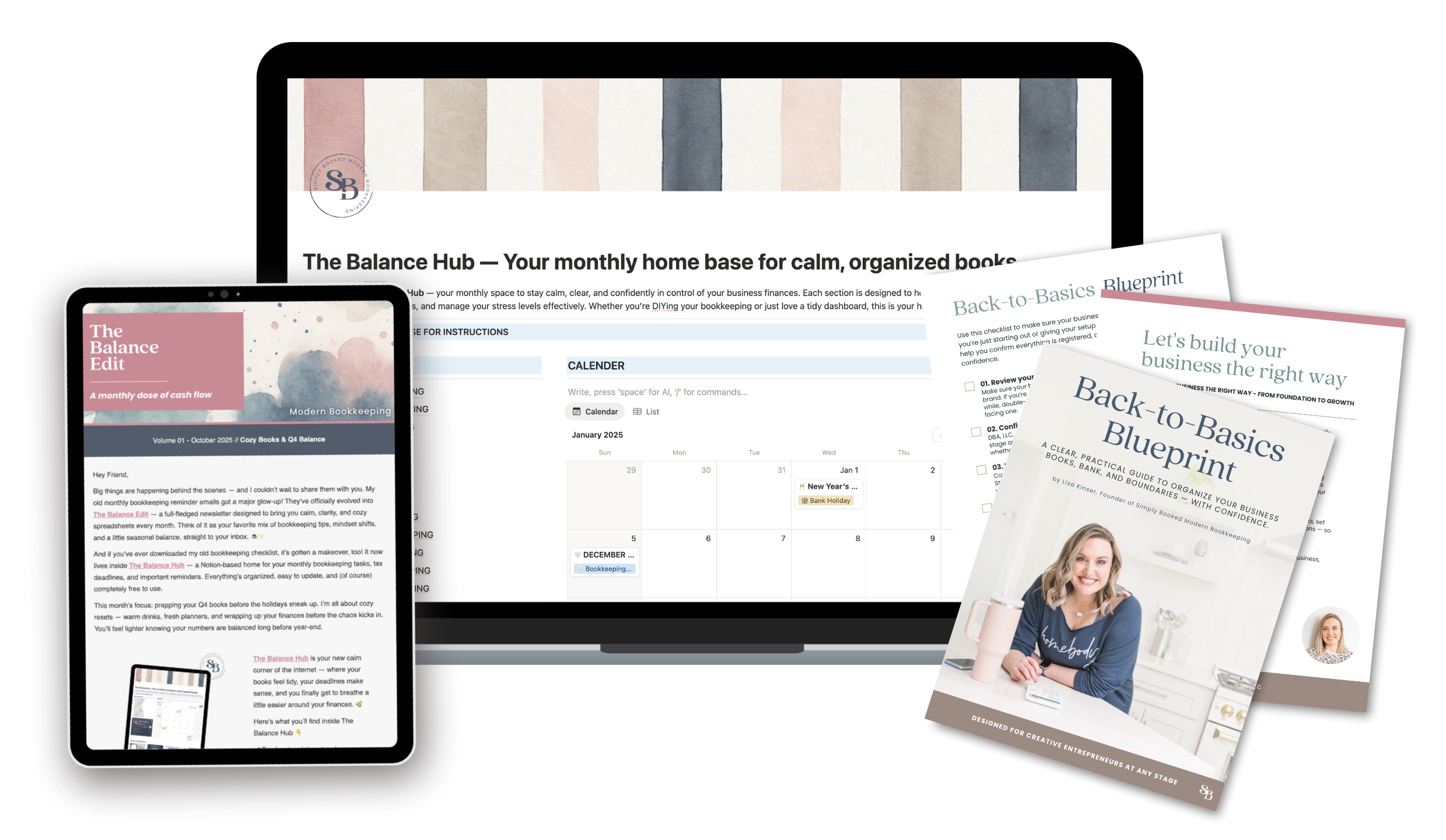

That's where bookkeeper comes in. Here's where we cut to a photo of me smiling with sparkly teeth and... I'm a bookkeeper. So there you have it. I'm just talking about the importance of having a bookkeeper. A bookkeeper will keep your business finances clean and organized all year, so you not only have a polished report to send to your CPA at tax time, but you get the huge added benefit of knowing your numbers in real time.

That's the [00:06:00] important part. You need to know them in real time, so you can make smart and empowered decisions. About how you run your business, you can see where your money's coming from. Where it's going in time to pivot if necessary, if something isn't working don't you want to know sooner than later.

Wouldn't it be nice to be able to pivot mid-year instead of waiting until the end of the year and realizing that your sales just completely dropped because maybe it was an off season. Or maybe there was that big storm and the power went out or you never know, but it's nice to know. In the moment.

How you can pivot because then you can actually react to the market in real time. That's the biggest benefit of having a bookkeeper. I understand not everyone is able to hire a dedicated bookkeeper and I don't recommend business owners try to use complicated accounting software like QuickBooks or Wave. Wave is just bad. I see people, sorry, this is a side [00:07:00] tangent, but Wave is not good. And I see business owners all the time recommending Wave because it's free or because you can send invoices for free, but it's free for a reason. It's not, it's no good. Even my preferred bookkeeping software, which is Xero, I don't recommend that business owners use that because you're not trained to use it. It can hide mistakes by giving you pretty reports, it makes a lot of assumptions that you might just accept instead of knowing really what it should be and making those corrections. So the numbers could be way off and without a trained eye, and knowledge of how the system works, you can end up with more of a mess than if you didn't have a system at all. Let me say that again. If you use accounting software that you're not completely trained with. You will end up with more of a mess than if you didn't have a system at all, you can end up paying someone a [00:08:00] lot of money to clean up your mess.

So don't do that. I recommend a spreadsheet. It's one that I'm developing currently, and it's a great solution for this situation. I'm very excited about it, I've been working really hard on this, and I know it will be a good solution for many business owners who aren't quite ready for a monthly bookkeeper.

So be sure to check the show notes for the link and join the wait list if that sounds like something you're interested in. If you join the waitlist, I'll keep you updated on some opportunities to get the whole training and the template for free! Like maybe some giveaways or drawings or something I'm playing around with a few different ideas, but join the wait list if you want to be included in those details as I make those decisions. But trust me, it's going to be so good. So thanks for tuning in and I'll see you next time.

OUTRO

---

Lisa: Thank you so much for listening, and you've made it [00:09:00] all the way to the end! To view the complete show notes and all the links mentioned in today's episode, please visit simplybooked.llc/podcast. And before you go, make sure you leave a rating and review because even though it just takes a few seconds, it really does make a difference. Thanks again for joining me in this episode of The Simply Booked Podcast i'll see you soon!